Most of that growth will be in Northern Virginia.

With more than 373MW of new data center capacity under construction, CBRE is forecasting that total data center inventory will grow by 13.8 percent in 2021.

CBRE’s forecast’s come from its 2021 Market Outlook which covers the real estate market and all potential impacts such as the US Election, green energy, and Covid-19.

The document reads: “The US wholesale data center market continues to benefit from the critical role that data centers play in supporting business operations. Continued adoption of hybrid information technology (IT) and cloud services, the growth of artificial intelligence (AI) technologies, and an ability to support a dispersed workforce will drive industry growth over the next several years.”

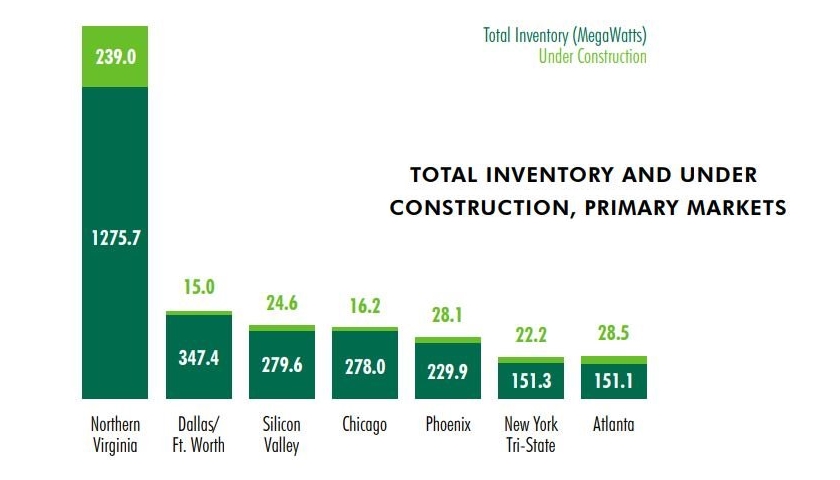

According to CBRE, most growth in the US predominantly went to Northern Virginia (the largest) Dallas/Ft Worth, Chicago, Silicon Valley, Phoenix, New York, and Atlanta markets. However, CBRE does expect the data center market to begin leveling out in 2021 as demand starts to plateau. Dallas is already starting to see real issues of demand being outpaced by supply.

Coming in at 1.3GW of capacity, Northern Virginia makes up the busiest development market as hyperscalers like Google, Microsoft, and AWS hoover up capacity – leveraging both wholesale facilities and building their own hyperscale data centers. For next year, Northern Virginia is seeing 239MW billed for construction in 2021, its next nearest location is in Atlanta with 28.5MW planned.

As more and more companies begin to adopt a cloud or hybrid-cloud approach, the growth potential for smaller providers looks to suffer. According to CBRE, facilities with “potential for scalability, high connectivity and proximity to cloud on-ramps” are better positioned, “than older, smaller assets with less ability to support the evolution of data center technology.”

However, the data center market looks to be inviting for investors as interest increases. CBRE reports that REITs, with data center holdings, are experiencing around 28 percent revenue growth year-to-date.

As a result, CBRE says we have to watch out for hyperscale cloud providers and any possible migration by enterprise users to the cloud following the Covid-19 pandemic. This could cause a knock-on effect on pricing in the industry but it’s unclear whether the average cost will be going down or will get unstable as supply gets eaten up.

Source: datacenterdynamics.com